An often overlooked way to save money is to pay off debts faster. The money saved in interest alone can be hundreds, if not thousands of dollars.

This strategy is most beneficial with a fixed term loan such as a car loan. If you pay on time, the balance will only go down. As the amount owed decreases, so does the amount of interest you are paying on that auto loan.

Here are some tips on how to pay a car loan faster and reduce the balance:

- Higher down payments – Even if it is only a few extra hundred dollars, the more you put down, the less interest you will expect to pay over the life of the loan.

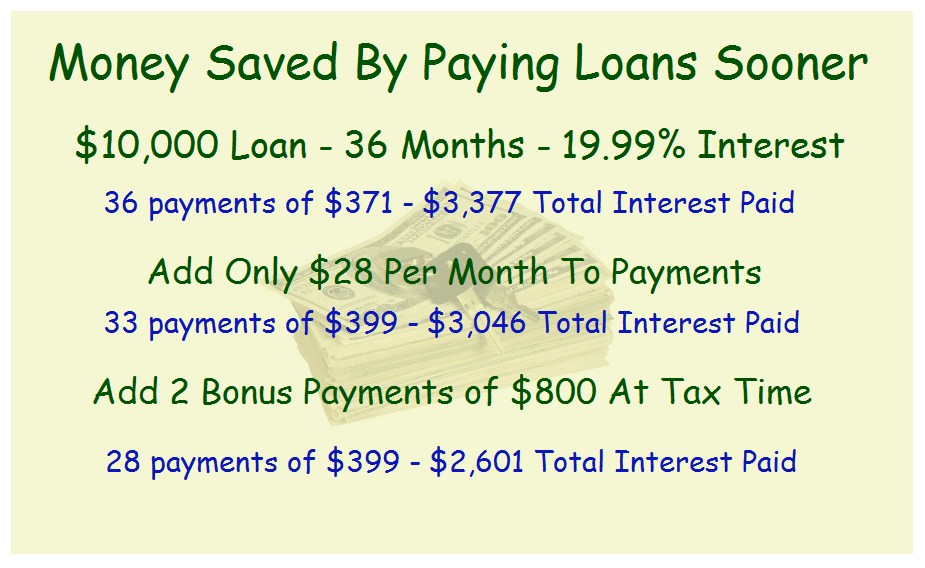

- Higher monthly payments – In the example below, you can see the difference made when paying $399 per month instead of $371 per month.

- Bonus Tax Refund Payments – The average refund for a customer using the Drive Now Network is approaching $5,500. Why not take a small portion of that and INVEST it in yourself. If you take $800 out of each of the next 2 tax refunds to apply to your car loan, you can save yourself $2,000 in car payments and another $445 in interest!

- Re-finance your car loan – If you have made on time payments for the first 12 or 18 months, go to a credit union or bank to see if they will refinance the loan with a lower interest rate. Odds are your credit score will be better than when you bought the car, putting you in a position to save more money!

MOST of the dealerships on www.DriveNowNetwork.com can help you with the tax refund, bonus payment option. They will even help you save money in processing the tax return for you.

The average customer that files their taxes with Tax Max via the Drive Now Network saves 40%-60% in tax preparation fees when compared to the national chains. That can be another $200 in your pocket! Best of all, the trusted dealerships in the Drive Now Network will put your tax refund on a Prepaid Tax Max Debit Card or hand you your tax refund check balance after your bonus payment.

And remember, the sooner you pay off your car, the sooner the dealer can report to the credit bureaus PAID AS AGREED. That means more money for you and a higher credit score.