What Do I Do With My Self Employed Taxes?

NOTICE: The following post in for general informational purposes only. Not every person has the exact same tax situation. Seek the advice of a trusted tax professional before taking action of your personal taxes!

You may or not realize it, but the IRS might consider you to be self employed. If you do not get a W-2 Form from your employer, this could be the case, especially if you had zero taxes taken out of your paycheck or are paid cash. If you make more than $600 for the year with a single source, they are required by the IRS to issue you a 1099-MISC form. The income is often reported in Box 7.

Now, a 1099 form does not automatically mean you are self employed. It could be a 1099-R, 1099-C, or 1099-GOV. All of these are NOT self employed. Even if you get a 1099-MISC Form, income in boxes 2 or 3 (for example) are also NOT self employed.

Many professions that end up being self employed are hair dressers, baby sitters, house cleaners, lawn service providers, Uber and Lyft drivers, taxi drivers, newspaper delivery, couriers, and non W-2 truck drivers. Although your income gets taxed by an additional 7% to 5% AND gets taxed all at once when you file, you also get to deduct expenses that helped you make that money.

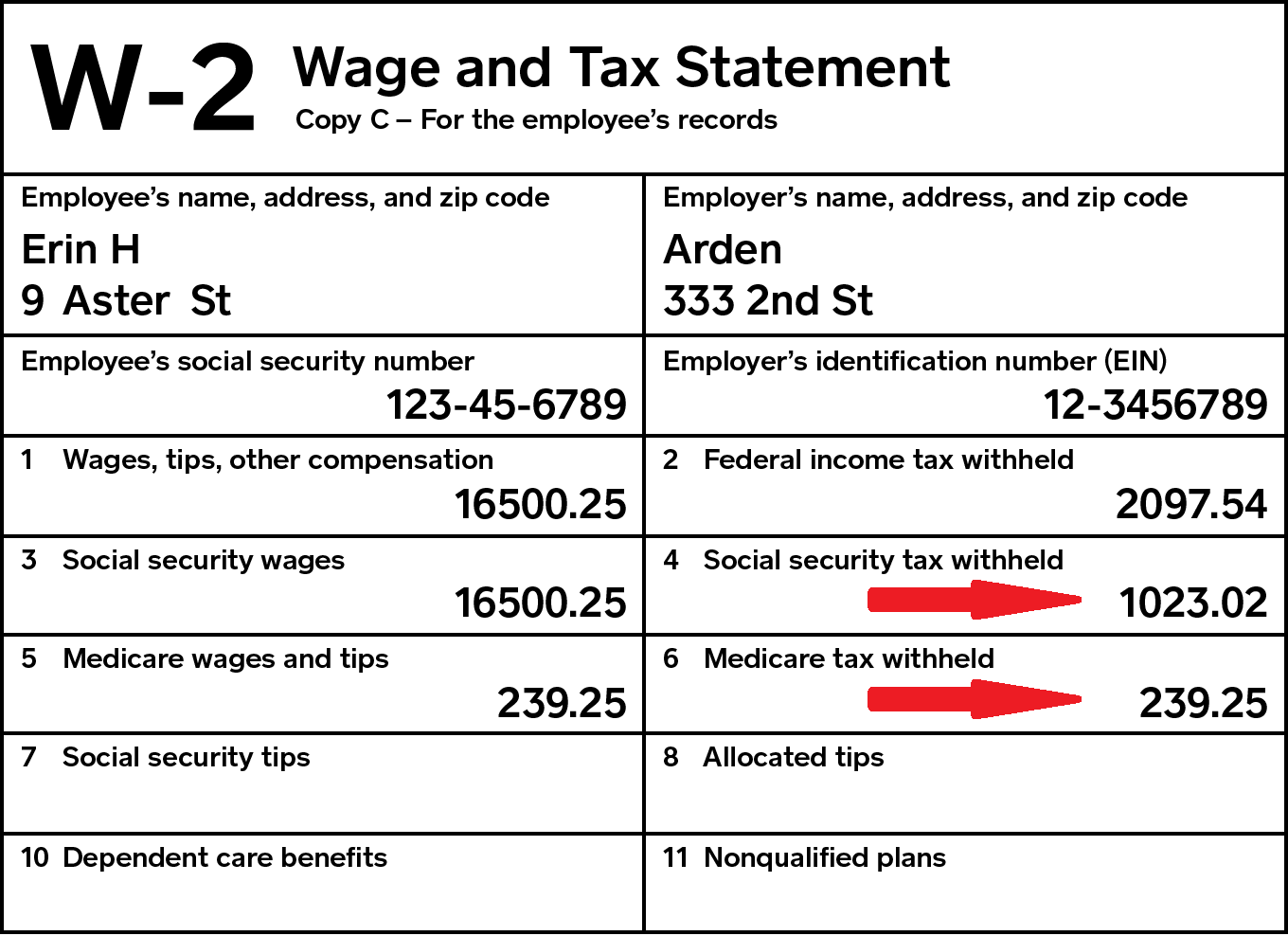

How do the numbers shake out? In a W-2 job, a little over 6% gets taken out every week for Social Security and almost 1 ½% gets taken out for Medicare Taxes. Your employer then MATCHES those amounts, for a total of over 15% when you combine both sides paying both taxes. You then have your Federal Income Taxes that can be withheld out of each W-2 paycheck.

When you are self employed, nobody is paying into that system throughout the year, so you are required to pay all of it at the end in the form of a Self Employment Tax. This often causes people to get lower refunds when they are self employed as compared to the same income levels on a W-2.

So how do you prepare for next year? It is never too late to start keeping and tracking your expenses and information. Ask your tax professional for more details, but here are some general tips to help you as we get into tax season. At a MINIMUM, be sure to track the following:

Income – this is easy. Anytime you get paid, it is income. Tips included.

Expenses – track everything, even if you are not sure. Let your tax professional tell you if it does or does not count. Do not rely on what a friend or co-worker tells you.

3 Expense Minimum – If your income is within a certain range that yields you the maximum amount of Earned Income Tax Credit (that’s another blog post altogether), you could be at greater risk for an audit if you do not report expenses with your self employed income. Some tax professionals require at least 3 expenses in order to ensure you are really a business. The IRS requires the preparer to make reasonable inquiries to make sure you are not taking advantage of the Earned Income Tax Credit system.

To help you think about expenses, here are some categories to think about:

Miles OR Fuel Costs – Miles are easier to track and they are meant to cover general wear and tear on your vehicle. Many people find that the 55 ½ cents per mile more than compensate for the actual costs of using the vehicle. However, you can NOT take both miles AND fuel costs!

Cell Phone – what percentage of your cell phone use is for work? Did you have to upgrade your minutes or data plan for work?

Meals – Track how much you spend on meals while you work. Again, your tax professional can go through to decide if something does not count.

Supplies – Uniforms WITH a company logo, protective gear, tools, cleaning supplies, diapers for babysitters, scissors for hairdressers, multi-device charger cords for Uber & Lyft drivers, or bags and string for news paper delivery people are all examples of supplies that may be unique to your job.

Office Supplies – Pens, paper, toner, printers…any general office supplies can go here. These supplies MUST be for business purposes! No cheating.

Overnight Travel – motel stays

Vehicle or Equipment Rental – Did you have to rent a truck or a chainsaw for work? Save the receipt and ask your tax professional

Other expenses: postage, professional insurance, continuing education, classes, equipment fuel (NOT car fuel), business cards, advertising, storage space, and signage