How Can I File An Extension?

Ahhhh, extensions. Quite possible the most over-requested and mis-understood form in the tax business.

First things first; if you are due a refund from the IRS, you do NOT need to file an extension. You have 3 years from that April 15th date to claim that refund. IRS fines on individuals for not filing a refund-due return by the April 15th deadline is almost unheard of.

Think of it this way…the IRS owes you money. Why would they care if you filed late?

The failure to file penalty is normally 5% of any unpaid taxes for each month or part of a month that a tax return is late. If you are due a refund, this does not apply and the IRS will not pay you 5% for filing later.

In April, a good way to test your tax professional to see if they are 100% honest with you is to call them with the extension question. If they are willing to charge you for an extension when you are expecting a tax refund, RUN! You do not want to be doing business or trusting your personal and financial information with anyone willing to overcharge you for something you do not need.

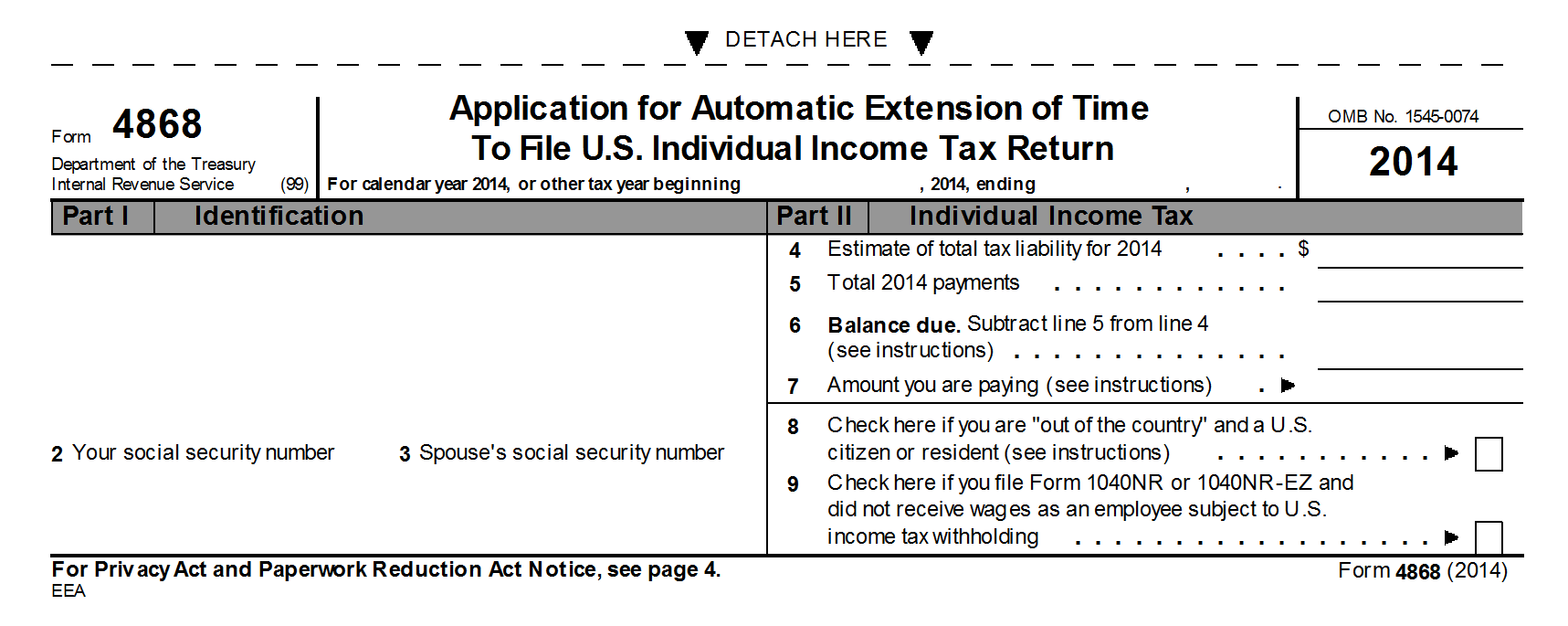

Second, if you DO owe the IRS, you still have to pay by April 15th. IRS Form 4868 is an extension to file your tax return, not an extension to pay what you owe.

People who have all of their forms ready and together by April 15th just need to file. If you owe, you owe. As long as you pay 90% of the taxes

CAUTION! If you file your return more than 60 days after the extended due date OR the April 15th deadline, the MINIMUM penalty is the smaller of $135 or 100% of any taxes that are unpaid. The only way around these fees and fines would be to show “reasonable cause” for not paying on time.

“Reasonable cause” could be medical related reasons or serving in a combat zone, for example.

For people who do owe, the IRS offers a payment plan request, which requires IRS Form 9465. WARNING: the IRS will charge between $43 and $105, depending on your situation. If you can pay within 120 days, installment plans with the IRS are free, however.

Further extensions may apply if you are living abroad or serving in a combat zone, but for almost everyone else, the standard extension time is 6 months. This means your tax return would be due by October 15th in most tax years.

The actual extension form is simple to fill out. The most difficult part is estimating the numbers on any forms that you are still waiting on. Form 4868 can be transmitted electronically to the IRS or mailed with your payment.

If you do electronically file an extension, remember to pay the estimated tax owed before the deadline passes.

Why Would I File An Extension?

The number 1 reason to file an extension with the IRS is due to someone else not sending you tax documents, such as a 1099 or K-1 income statement. Late W-2 forms or 1099-R forms could also be legitimate reasons to file an extension.

The 2nd reason to file an extension is if you are in a situation where it is impossible to complete your paperwork by midnight on April 15th. But if you waited this long, a 6 month extension is nothing more than an invitation to procrastinate even further.

If at all possible, file by April 15th and pay the estimated damage to Uncle Sam. Simplify your life and just get it done.