I am self-employed. What should I keep track of?

As a tax preparer, self employed customers and small businesses are just a few of the tax returns I specialize in. As a small business owner myself, I am personally familiar with what is required and what can help you at tax time.

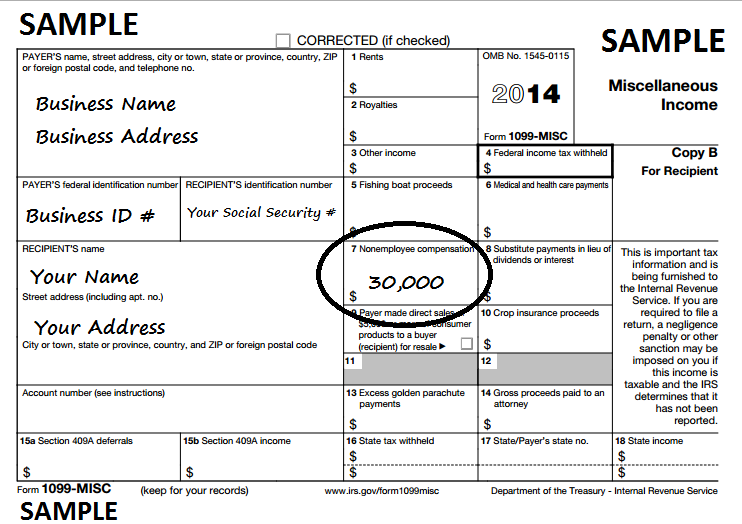

It is important to note that a Federal EIN or Employer Identification Number is not required to be a business. If you get a 1099-MISC for work provided with income in Box 7, that income needs to be reported on a Schedule C, making it business income.

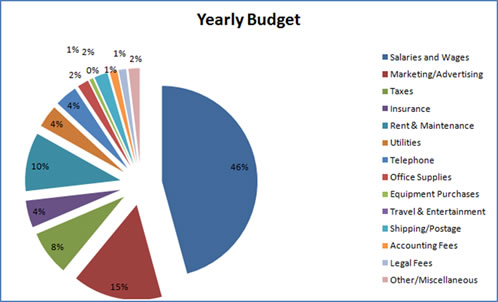

We will discuss how to deal with self employed taxes in a later blog post. Before you can determine taxes, you need to know your income and expenses. Expenses tend to be the most complicated due to the large number of available categories.

Personally, I track my expenses on a FREE website powered by Intuit, www.Mint.com. This website tracks all of the credit cards that you feed into it and allows you to categorize the expenses on them. I also use it for personal tax items like charitable donations and medical expenses.

Every week, I verify the categories of all of my expenses on Mint.com and also monitor for unexpected bank fees and fraudulent charges. It even helps you with budgets! At the end of the year, I create spreadsheets with all of my expenses and categories, which are easily to sort and total up for my tax return.

Here are the top pieces of advice of what to track if you are self employed.

Income – Very simple. All business related income needs to be tracked and recorded. An Excel Spreadsheet can be you best friend. Daily income needs to be recorded for easy totaling at tax time.

Business Miles – Unless you drive a gas-guzzler that runs at under 5 or 10 miles per gallon, business miles are almost always better and easier than gas receipts. The IRS allows for 55.5 cents per mile as a deductible expense. This includes gas, insurance, and wear and tear expenses. How many vehicles actually cost that much to run? Plus, at the end of the year, you don’t have to worry about all of those gas station receipts.

Meals & Entertainment – How much do you spend for meals while at work? Do you wine and dine business associates and customers? Save those receipts for your taxes. CAUTION: Make sure you limit this expense to business related items only!

Cost of Goods Sold – If you are in any kind of retail business, these can be some major expenses for you. Even if you are a service business, you may still have items for sale. Car repair companies, pool cleaning services, heating and air conditioning services are all examples of services that will also have a retail side as well.

Equipment – Keep the bill of sale for these large expenses. A good tax preparer will know whether or not to deduct the full amount paid or if you should depreciate it over multiple years. If you are already reporting a loss, you can save some of those major expenses for later years.

Marketing – Business cards, flyers, professional services websites (Angie’s List), any sales and advertising websites (Realtor.com, Craigslist, AutoByTel.com), Newspaper Ads…all of these expenses need to be tracked.

Utilities – Do you use your cell phone for work? Internet services? A portion of these can be used as expenses on your business return. Be mindful of what percentage of your usage is work related.

Home Office Expenses – In years past, Form 8829 has been good for 3 things: higher tax preparation fees, reduced tax exemptions on your personal residence, and increased audit risk. Reputable tax preparers warn their customers of these issues, while others just want to charge more fees.

The IRS now has a new method for Home Office Expenses; it is called the Safe Harbor Method. The best part is that it is MUCH easier to calculate. $5 per square foot is deductible each year as a business expense AS LONG AS you have an entire room that is used for 100% business expenses.

Other Expenses:

Repairs

Maintenance

Postage

Business related insurance

Overnight business travel

Office Supplies

Office Rental

Car Rental

Supplies

Taxes

Licenses

Legal Fees

Employee Wages

Non-employee Wages

CAUTION: If you claim non-employee wages, your business is REQUIRED to file a Form 1099-MISC for everyone making $600 or more. Even if you have 6 people that made $100 each, you should still issue a 1099-MISC for each person to avoid the watchful eye of the IRS.

The tracking of expenses is almost always more complex than income. Have a plan and find what tools work best for you. Otherwise, you will be stressed for the first 100 days of the year about doing your taxes before finalizing them on April 15th.