Is It Too Late To Contribute To Last Year’s IRA Account?

What is today’s date? As long as it is April 15th or before, then yes you can.

You are allowed to contribute backwards into an IRA up until April 15th of the following year. For example, you are able to contribute to your IRA and count it for 2014, as long as you contribute by April 15, 2015. The only stipulation is that you must inform your IRA provider that you intend for the contribution to be for the prior year.

If you have not fully contributed to your Traditional or Roth IRA by April 15th, this is a great opportunity to do so. Most financial advisors would tell you that it would be a mistake to not contribute to a tax deferred retirement plan, regardless of your age.

For Americans contributing to a Traditional IRA, you can see an immediate tax benefit. Unlike a Roth IRA, the contributions to a traditional are tax deductible. The downside is that the funds are taxable when you take them out during retirement.

Low to moderate income individuals may also qualify for an additional tax credit, on top of the tax deduction, for IRA contributions. Ask your tax professional about IRS Form 8880 and whether or not you qualify for the Retirement Savings Credit.

Later in life, investing today into a Roth IRA can yield the greatest benefit. Every dime inside a Roth IRA is tax FREE after 59 ½ years of age! Many people look down upon a Roth due to the lack of tax benefit today, but most financial advisors favor the benefits of a Roth over a Traditional IRA.

Speak with your investment advisor before making any investment decision.

Why does this matter?

Albert Einstein is quoted as saying “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

At retirement, less than 20% of what you put into your retirement should be the actual contributions that you made. 80% or more of your eventual nest egg should be gains on those investments.

Remember though, once the tax deadline passes, the opportunity to contribute for the year is gone. You can not go back and that opportunity to take advantage of the TAX FREE compound interest is GONE!

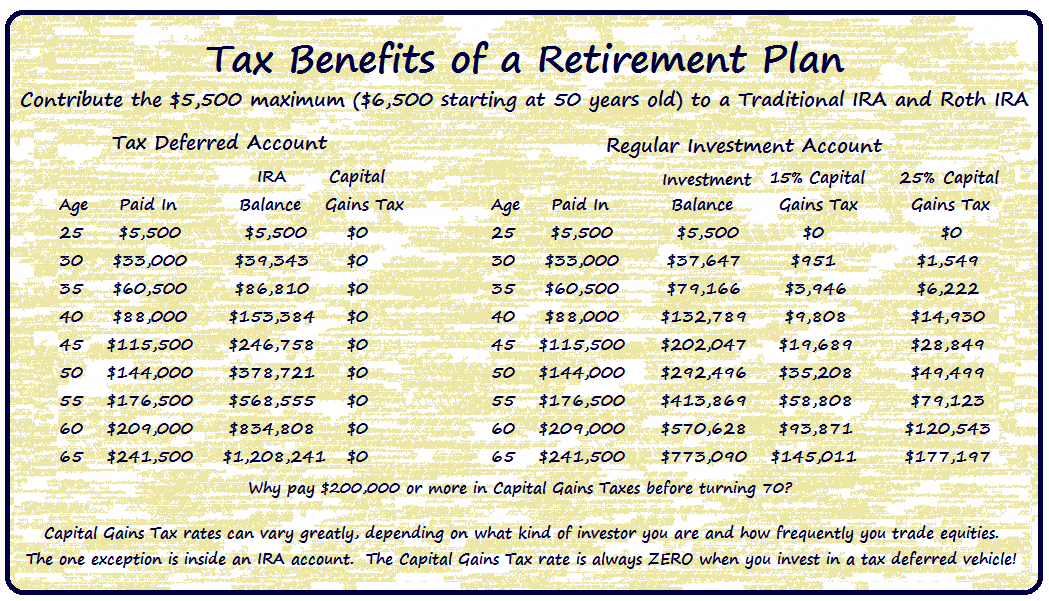

American taxpayers are only allowed to contribute a certain amount to their IRA accounts each year. If you are single, that limit is $5,500 as long as you are under 50. That limit increases to $6,500 for the ages of 50 and above

The fact that Uncle Sam sets a limit on contributions should alert you to the fact that the benefits of an IRA account are HUGE.

Keep in mind that the same numbers in the chart apply to any 401(k) plans at work. Tax deferred is tax deferred. If you are fortunate enough to have a workplace retirement plan, the eventual goal should be to have a fully funded IRA and a fully funded 401(k) or similar account.

The Take-Away

There is a reason that the government caps the amount you are able to contribute to tax deferred retirement plans. The benefits are so great that the opportunity is very limited.

This should be your cue to sock away as much as you possibly can into these types of accounts.

If the date is April 15th or earlier in the calendar year, contribute for the prior year! Don’t let that window close without stuffing as much into that account as legally possible.